China Mainland Clients

Ultimate Beneficial Owner (hereinafter referred to as “UBO”)

The UBO refers to the person(s) who ultimately owns or controls a legal entity. Usually, the UBO is the person(s) who owns or controls 25% or more of the equity interests or voting rights of the entity, or exercises control over the entity through other means.

The UBO you fill in must be consistent with the actual situation. In order to verify the information you provide, we may verify the accuracy of the name and shareholding ratio of the UBO you provide through the National Enterprise Credit Information Public Disclosure System;

Meanwhile, in order to meet the requirements of local KYC regulations, we also need you to provide the image of UBO's identity document for verifying UBO's personal information.

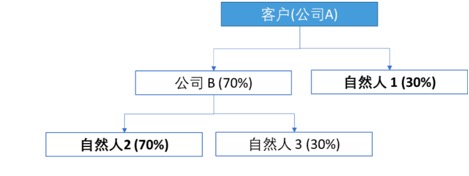

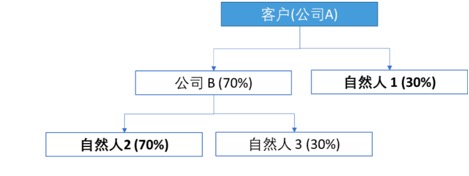

UBO Calculation Example:

To calculate indirect shareholding or voting rights, the calculation should be done by multiplying and summing up layer by layer, e.g.: Natural Person 1's shareholding = 30%; Natural Person 2's shareholding = 70%*70% = 49%; Natural Person 3's shareholding = 70%*30% = 21%.

In the example above:

The UBO refers to the person(s) who ultimately owns or controls a legal entity. Usually, the UBO is the person(s) who owns or controls 25% or more of the equity interests or voting rights of the entity, or exercises control over the entity through other means.

The UBO you fill in must be consistent with the actual situation. In order to verify the information you provide, we may verify the accuracy of the name and shareholding ratio of the UBO you provide through the National Enterprise Credit Information Public Disclosure System;

Meanwhile, in order to meet the requirements of local KYC regulations, we also need you to provide the image of UBO's identity document for verifying UBO's personal information.

UBO Calculation Example:

To calculate indirect shareholding or voting rights, the calculation should be done by multiplying and summing up layer by layer, e.g.: Natural Person 1's shareholding = 30%; Natural Person 2's shareholding = 70%*70% = 49%; Natural Person 3's shareholding = 70%*30% = 21%.

In the example above:

- “Company A” refers to your company;

- “Company B” is a corporate shareholder of ‘Company A’, holding 70% of the shares of ‘Company A’;

- “Natural Person 1” is a natural person shareholder of ‘Company A’, holding 30% of the shares of ‘Company A’;

- “Natural person 2” is a natural person shareholder of ‘Company B’, holding 70% of the shares of ‘Company B’;

- “Natural person 3” is a natural person shareholder of ‘Company B’, holding 30% of the shares of ‘Company B’;

- Calculate the natural person shareholders who directly or indirectly exceed 25% of the shares have:

- Natural person 1's shareholding = 30%

- Percentage of equity of natural person 2 = 70% * 70% = 49

- Percentage of equity of natural person 3 = 70% * 30% = 21

Customers in Hong Kong, China (Business registered in Hong Kong, China)

Ultimate Beneficial Owner (hereinafter referred to as “UBO”) A natural person who directly or indirectly owns 25% or more of the shares of a business, or a person who has the right to make decisions on the development of the business;Example 1:

- “Company A” is your company; Company B holds all the shares of Company A, i.e. 100 per cent of the shares;

- Natural person C is a natural person shareholder of company B with 20% of the shares and natural person D is a natural person shareholder of company B with 80% of the shares;

- The shareholding structure of Company A is considered to have 1 intermediate layer (the layer between the company and its UBO);

- Company B is considered to be an intermediate entity shareholder of Company A;

- D, a natural person shareholder of Company A, holding more than 25% of the shares, is considered to be a UBO;

- C, a natural person shareholder of Company A, holds only 20% of the shares and is not considered a UBO.

- “Company A” means your company;

- Natural person shareholder B owns all the shares of Company A, i.e. 100% of the shares;

- A natural person shareholder B of Company A holds more than 25% of the shares and is considered a UBO.